It's been a while since I've updated CAGS. This is an initial post and may be modified to better fit with CAGS 2 later.

Revision: Schema updated to 3.2. See the previous 3.X schema(s) at the end of this post.

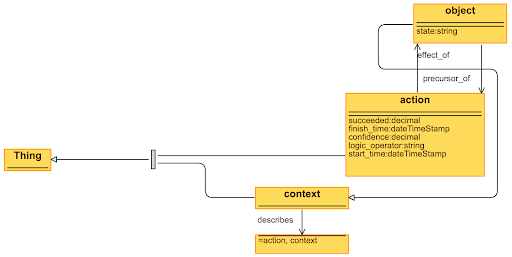

3.2 Schema

- All property names must be stored as lower case

- The graph must be a directed multigraph. It must be a combination of a causal bipartite multigraph with 'context, 'objects' (previously conditions, a subtype of context), and 'actions' (previously events) representing the two types of nodes and a knowledge simple graph defined in OWL used to describe the objects and actions.

- Action node properties. All other properties should be defined through the knowledge graph.

- type: "action" (required)

- id: A URI including the graph prefix identifying the node (required)

- name: The action that occured. This may be from a schema such as a VERIS action or ATT&CK technique, or may be an arbitrary string describing the action or event that took place. (required)

- start_time: The time the atomic the node represents began to exist. Time should be in ISO 8601 combined date and time format (e.g. 2014-11-01T10:34Z). If no time is available, minutes since unix epoch (1/1/1970 Midnight UTC) should be used as a sequence number. (required)

- finish_time: The time the atomic the node represents ceased to exist. Time should be in ISO 8601 combined date and time format (e.g. 2014-11-01T10:34Z) (optional but encouraged)

- logic_operator: a function (including the language the function is defined in) that takes the state of parent objects to the node as arguments (pre-conditions) and returns the effect(s) on child objects to the node (effects). (A characteristic borrowed from formal planning.) This may be ladder logic, first order logic, higher level languages such as python, machine learning model, etc. The values accepted per pre-condition and produced per effect must be in the same set as values used for the object node state property. In practice this will often be the identity function. (For example if a parent object's state is 'compromised', after the action the child object's state will be compromised. If missing, is assumed to be the identity operator transfering the set of all state from precursor objects to affected objects.

- succeeded: float from 0 (failed) to 1 (succeeded) or distribution representing the probability that action succeeded in its effects. Any effects which may be separable should be defined through a separate action. (optional)

- confidence: float from 0 to 1 or distribution representing the confidence that the action succeeded. (optional)

- Context node properties. All other properties should be defined through the knowledge graph. These definitions may take the from of an existing schema such as VERIS assets, the CARS data model objects, or other ontologies of objects defined through a knowledge graph.

- type: "context" or "object" (required)

- id: A URI including the graph prefix identifying the node (required)

- Object node properties. Object nodes are a sub-type of context in that they may be instanced and have a 'state' which changes as actions are applied. Only object nodes may be part of the causal graph.

- state: A property that may be used as a transient string representing the state of the object during a point in time representing the current state of the system. The sum of all object states is the state of the system. This may be as simple as "compromised", from an ontology such as VERIS attributes, the Confidentiality, Integrity, Availability triad, Bayesian or DIMFUI (Degradation, Interruption, Modification, Fabrication, Unauthorized Use, and Interception), or it may even be an arbitrary string.

- Edge Properties:

- source: the id of the source node. Object nodes may only have sources of action nodes and action nodes may only have sources of object nodes. All nodes part of the knowledge graph may only have sources within the knowledge graph or an object node. (required)

- destination: the id of the destination node. Object nodes may only have destinations of action nodes and action nodes may only have destinations of object nodes. All nodes part of the knowledge graph may only have sources within the knowledge graph or an object node. (required)

- type: Edges between actions and objects (in either direction) have a type from the set of states acceptable for the object node state property and must agree with the pre-conditions and effects of the action node involved's logic operator. All other edges are defined by the OWL knowledge schema. (required)

- The acceptable edge types are: "precursor_of" (edge from an object to an action), "effect_of" (edge from an action to an object), "describe" (edge from an object or context to an object, context, or action).

- id: A URI representing the edge. (optional)

- It is intended that sets of nodes and edges in the graph can be joined to create a subgraph represented by a single node. The node must still obey all previous schema requirements.

Strengths

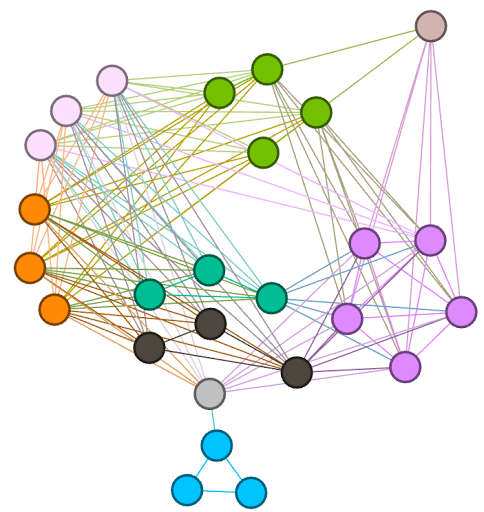

- The use of knowledge graphs to provide properties simplifies defining arbitrary sets of properties. This is incredibly important as different users will want to represent different properties at different levels of detail. In Figure 1, Object 3 is a process linked to it's higher level representations. However the dotted lines show how Objects 5-8 could be used if the goal was a higher level representation of the incident.

- The use of a logic operator allows for arbitrary logic in progressing through the graph without creating complex graph structures to try and define the logic. This effectively replaces the Bayesian Conditional Probability Tables in version 2.

- The action-object bipartite graph provides the ability to represent complex relationships (as a bipartite graph can represent hypergraphs and simplicial complexes, or dendrites) while still maintaining the strengths of traditional graphs. It allow allows moving almost all properties to nodes or to the knowledge graph.

- The use of properties defined without schemas (action node action, action node logic operator, object node knowledge graph, and object node state) allows the schema to be "specifically vague" (credit to Gage for the term). Enough to be clear but vague enough to support varying use cases.

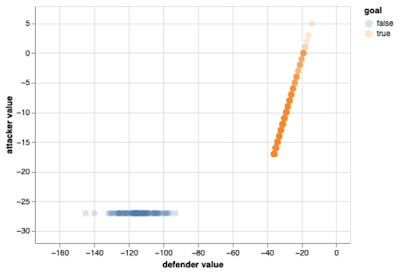

- The set of object states is the state of the system the graph describes. To determine the state of the graph at given time, all actions must be applied in order. This provides for state management without state explosion.

- The schema does not define how parent-child relationships are established (though it is logical that children must come after parents and that parents/children are limited by the objects an action requires tas pre-conditions and the objects it may affect.

- The schema does not define how to identify duplicate objects within the graph (where a a single actual object is represented by two object nodes). When a schema is not used to help avoid duplication, I envision tools that tools will be available to help identify duplicates through their knowledge graph properties. OWL allows for the same object to exist as different notes in the same knowledge graph.

- The schema does not readily distinguish between ground truth and records used to observe ground truth. Care must be taken to distinguish these two types of actions and the associated objects. For example, a record may be an object child of the action that generated it. Figure 2 provides an example. The characteristics of the record can be as simple or as detailed as desired though it's prudent to consider the ability of the graph to scale to represent instances of records.

- The schema does not explicitly define actor, however it may be a relationship established in the knowledge graph and is considered a best practice.

Example

Representations

This OWL file can be found here. CAGS graphs conforming to this format should be stored as triples in JSON-LD format. If converting to a property graph, the graph should be stored in JSON Graph Format (JGF).

Use Cases

Aggregation of Events

Motif Communication

Attack Surface

Attack Graph Generation

Analysis

Incident Documentation

Detection

Simulation

Incident Response

Defense Planning

Risk Analysis

3.1 SCHEMA

- The CAGS 3.1 'uuid' property has been replaced with an 'id' which uses URIs including graph namespaces instead of UUIDs

- CAGS 3.2 adds allowed edge types

- CAGS 3.2 adds 'context' nodes

- Added representations

- Described logic_operator as optional but with a default representation if missing

- Renamed the 'action' property of actions to 'name'

3.0 SCHEMA

The attack flows are defined with nodes as objects and their individual actions as hyperedges. Nodes maintain their individuals state with respect to security while edges document how state is changed by the edge. Edges also contain the logic to adjudicate complex interactions between inputs. The attack flow (or graph) in its entirety represents the state of the system (or portion of the system) being described.

NODES TYPES:

- Datum

- Person

- Storage

- Compute

- Memory

- Network

- Other

- Unknown

- leads_to